It has finally happened! The Iraqi Dinar (IQD) has revalued to an incredible rate of 3.47 IQD to the USD, and the global economic community is buzzing with excitement. Whether you’ve been closely following the foreign exchange market, invested in IQD, or are simply curious about what this revaluation means, you’re in the right place.

This blog will walk you through what a currency revaluation is, why the IQD’s revaluation is significant, and what impacts this change may have on individuals, investors, and global markets. We’ll help you understand the numbers, give you insights into the potential benefits, and leverage expert perspectives to uncover why 3.47 is such a game-changing rate. Stay with us—we’ve got everything you need to know!

What Is Currency Revaluation?

Let’s start with the basics. A “currency revaluation” occurs when a country’s central bank or government adjusts the value of its currency in relation to other currencies. This typically happens in managed exchange rate systems where a government sets a fixed value for its currency against major international currencies such as the US dollar (USD) or the Euro.

Revaluation happens when a currency’s value increases in comparison to foreign currencies. It’s the opposite of devaluation, which is when a currency’s value is reduced. A revaluation is usually a sign of economic growth, better financial stability, or the implementation of sound fiscal and monetary policies.

For Iraq, the revaluation of the IQD signals a monumental moment. Emerging from years of economic challenges, the IQD achieving a rate of 3.47 to 1 USD is an indication that Iraq’s overall economic health has improved substantially—and the world is taking notice!

Why Is the IQD’s Revaluation to 3.47 Significant?

The Iraqi Dinar’s revaluation is more than just an adjustment in numbers—it’s a seismic shift for Iraq’s economy and for stakeholders around the globe. At a rate of 3.47 IQD per USD, this new valuation holds specific significance:

- Economic Stability for Iraq

A stronger IQD reflects increased confidence in Iraq’s economic infrastructure. Oil exports, one of Iraq’s main economic drivers, have likely fueled this growth alongside improved governmental policies. This revaluation can attract more foreign investments, reduce national debt, and aid the local population in trading internationally at better rates.

- Investor Confidence

For years, many have speculated about an IQD revaluation and held dinars in anticipation of this day. A conversion rate of 3.47 translates into a substantial return on investment for those who held onto IQD while it was valued much lower. Markets love confidence, and this revaluation may indicate Iraq’s economy is gearing up for sustained growth in the coming years.

- A Boost for Global Trade

With a more valuable currency, Iraqi businesses might find it easier to import goods and services, diversifying their economy further beyond oil. This can create trade opportunities, strengthening Iraq’s partnerships with countries across the globe.

- Symbol of Progress Post-Recovery

For a country that has faced decades of conflict, economic restrictions, and internal struggles, the IQD’s revaluation is a triumph. It represents recovery, resilience, and optimism for Iraq’s future in the global economy.

How the Revaluation Impacts Investors and International Markets

If you’re an investor or business owner dealing in foreign exchange, the IQD’s new valuation is likely catching your attention. But what exactly are its broader financial implications?

Currency Holders, Rejoice!

This is great news for those who purchased IQD when its value was lower. Converting IQD at 3.47 per USD means many will see substantial returns. It’s essential, however, to act with caution, as foreign exchange markets can fluctuate significantly due to economic or political shifts.

Global Markets Take Notice

Iraq is a key player in the oil industry, and a revalued IQD signals progress. International markets dealing in oil will likely experience changes in trading prices, with Iraq’s standing as a supplier shining even brighter post-revaluation.

More Business in Iraq

Companies operating in Iraq or with plans to expand there may view the revaluation as a sign of increased financial and economic stability. With a stronger currency, Iraq becomes a more attractive location for international trade and partnerships.

Local Iraqi Citizens

A revalued IQD should increase the purchasing power of the average Iraqi citizen. Imported goods and services may become more affordable, leading to an improved quality of life for the country’s population.

What’s Driving the IQD’s Value?

If you’re wondering what caused such an impressive revaluation, here’s what experts believe to be the key factors:

- Oil Revenue

Iraq is one of the top oil-exporting nations in the world. With stable or rising oil prices, Iraq is reaping the rewards of its vast petroleum reserves. Increased income often contributes to a stronger currency.

- Improved Monetary Policies

Iraq’s central bank has likely implemented effective monetary strategies, tightening inflation, stabilizing inflation rates, and maintaining healthier foreign exchange reserves.

- Favorable International Relations

An improvement in diplomatic and trade relations may also have contributed to optimism around Iraq’s economy.

What’s Next?

The IQD’s revaluation is a major milestone, but what happens from here? Several possibilities include continued currency stability, more growth opportunities for businesses within Iraq, and potentially further appreciation of the dinar. Investors should closely monitor the financial news while exploring ways to capitalize on this new reality.

Thinking About Investing in Forex? Key Points to Remember

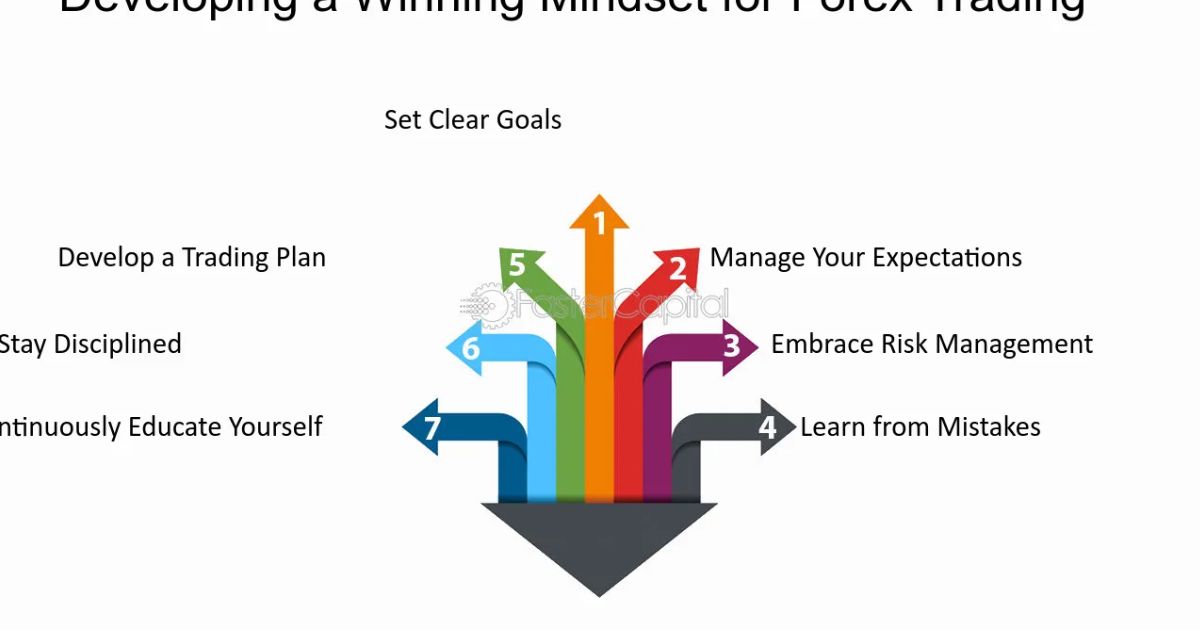

If the IQD’s revaluation has got you considering other currency investments or foreign exchange (Forex) opportunities, here are some tips before you start:

- Research Is Essential

Study the economic and political landscapes of any country whose currency you’re considering. Forex can be volatile, and informed decisions are key to mitigating risk.

- Diversify Your Portfolio

Don’t put all your eggs in one basket! Spread your investments across different asset classes to manage risk effectively.

- Partner with Experts

Consult with Forex or financial advisors with proven experience to ensure you’re making sound choices.

Experience the Moment of Change

The IQD reaching 3.47 to the USD is a moment of monumental change for Iraq and for everyone with a stake in its economic success. Whether you’re an investor seeing remarkable returns or a curious individual exploring the implications of currency revaluation, this moment is one worth celebrating and analyzing.

Stay informed and be strategic—whether you’re looking to invest further or simply enjoy the stories that will unfold. Stay tuned for future updates and insights as we continue covering this historic financial event.